Managing the finances of your home service business doesn’t have to be a headache. In today’s world, there are countless software development services available that can help you track and control your monetary flow more effectively.

In this blog, we’ll delve into the importance of accounting software tailored specifically for home service businesses, and explore some of the best options on the market.

But before we get started, let’s give you a quick run-through of the basics –

What is accounting software?

Accounting software is a program that allows you to automate bookkeeping tasks, such as recording transactions, maintaining financial records managing invoicing, and generating financial reports. It can also help improve the efficiency and accuracy of your business’ financial operations.

How does it work?

Accounting software works by providing the user with an organised system for maintaining accurate financial records. It often has features that simplify data entry, categorise transactions, monitor expenses, and even help with tax preparation.

Is it safe?

Yes, most modern accounting software comes with built-in security measures to keep your financial data safe and secure. Always make sure to choose a reputable product and follow best practices for safeguarding your data.

Why is accounting software important for home service businesses?

Running a home service business involves juggling multiple tasks, from managing employees and inventory to providing quality services to customers. With so much on your plate, it can be easy to overlook the financial aspect of your business. However, keeping track of your finances is crucial for the success and growth of your business. Here are some reasons why accounting software is a must-have for home service businesses:

- Accurate financial records: Accounting software helps you keep track of all your expenses, income, and profits in one place. This makes it easier to generate reports and analyse your financial data accurately.

- Saves time and effort: Instead of manually recording transactions and crunching numbers, the right accounting software can automate these tasks and save you time and effort. This allows you to focus on other important aspects of your business.

- Easier tax compliance: With accurate financial records, filing taxes becomes a much smoother process. You can generate reports and track deductions, making it easier to file your taxes correctly and avoid any penalties or audits.

- Identify areas for improvement: By analysing your financial data, accounting software can help you identify areas where you can cut costs and increase profits. This can lead to more efficient operations and better overall business performance.

Factors to consider when comparing accounting software

When looking for the perfect accounting software for your home service business, consider the following factors:

- Ease of use and intuitive interface

- Budget constraints

- Cloud-based or on-premise solutions

- Integration with other business applications

- Customisability and features specific to home service businesses

Now that you understand the importance of accounting software for your home service business, let’s take a look at some of the top options available:

Top 10 Accounting Software for Home Service Businesses

Below, we’ll introduce you to some of the best accounting software options tailored for home service businesses:

1. QuickBooks Online

What it offers:

QuickBooks Online is a comprehensive accounting solution that helps businesses manage income, expenses, and invoices. It also provides features like mileage tracking and project profitability analysis.

While QuickBooks may have a slight learning curve, it provides a free guided setup for new users. This ensures that you can easily familiarise yourself with its modern interface features, such as connecting and tracking bank transactions, as well as automating repetitive tasks.

How it can help your business:

It’s user-friendly, scalable, and offers robust reporting tools. Home service businesses benefit from its invoicing capabilities and easy integration with other business apps.

With QuickBooks, you can steer clear of any unexpected issues by relying on its automated quarterly tax calculations. Additionally, you have the option to utilise its pre-set categories or configure your system to automatically track and categorise expenses. This ensures that you’ll always have the necessary documents readily available to identify deductions and stay compliant with sales tax regulations.

2. FreshBooks

What it offers:

FreshBooks is a cloud-based accounting software designed for small businesses. It excels in invoicing, time tracking, and expense management, making it a perfect fit for service-oriented businesses.

FreshBooks enables you to effortlessly monitor all client-related information, including comprehensive profiles, account statements, estimates, proposals, and time-tracking. With these features, you can eliminate uncertainty in project planning and start your projects with clarity.

How it can help your business:

Its intuitive interface, automated invoicing, and ability to accept online payments streamline financial tasks. FreshBooks is an excellent choice for home service professionals who want simplicity without sacrificing functionality. To simplify your invoicing procedures, consider using advanced tools available today. For example, the invoice generator by Invoice Simple allows you to create professional invoices quickly. Additionally, such tools save time and reduce errors.

3. Wave

What it offers:

Wave is a free accounting software that includes invoicing, expense tracking, and receipt scanning. It’s particularly popular among freelancers and small businesses, offering essential features for financial management without the price tag.

While it may lack the extensive features of other platforms and may not be suitable for complex businesses, Wave is a great option for beginners managing a small home-based business. It’s worth noting that Wave offers some of the best mobile apps for home business accounting, making it an excellent choice for professionals who are constantly on the move.

How it can help your business:

It’s a cost-effective solution that provides essential accounting tools. Home service businesses appreciate Wave’s simplicity and the fact that it doesn’t charge monthly fees.

4. Xero

What it offers:

Xero is a cloud-based accounting software that offers features like invoicing, bank reconciliation, and reporting. It also integrates with over 800 business apps, making it a versatile option for growing businesses.

It also enables you to utilise saved contacts, pricing, and inventory information to generate quotes in a matter of seconds. This means you’ll save time on repetitive tasks, making it an excellent choice for smaller teams that don’t have a dedicated accountant.

How it can help your business:

With a user-friendly interface and strong mobile app, Xero is ideal for busy home service professionals. Its real-time collaboration features allow seamless communication with accountants or team members.

Xero also simplifies interactions with third parties by allowing you to create and save quotes online or convert them into invoices with just one click.

5. Zoho Books

What it offers:

Zoho Books is another cloud-based accounting software that offers invoicing, expense tracking, and project management features. It also integrates with other Zoho business apps for seamless data transfer.

Zoho Books is recognised as a solid platform for streamlining business workflows and payments. By offering advanced features like recurring invoices and profiles, it can speed up multiple tasks.

How it can help your business:

Zoho Books stands out with its affordable pricing and integration capabilities. Home service businesses benefit from its automation features, which save time and reduce manual data entry.

With Zoho, managing projects becomes effortless. You can easily track project hours using its mobile apps, collect advance payments, and efficiently manage expenses. Furthermore, integrating with Zoho Projects provides access to high-quality project management software features.

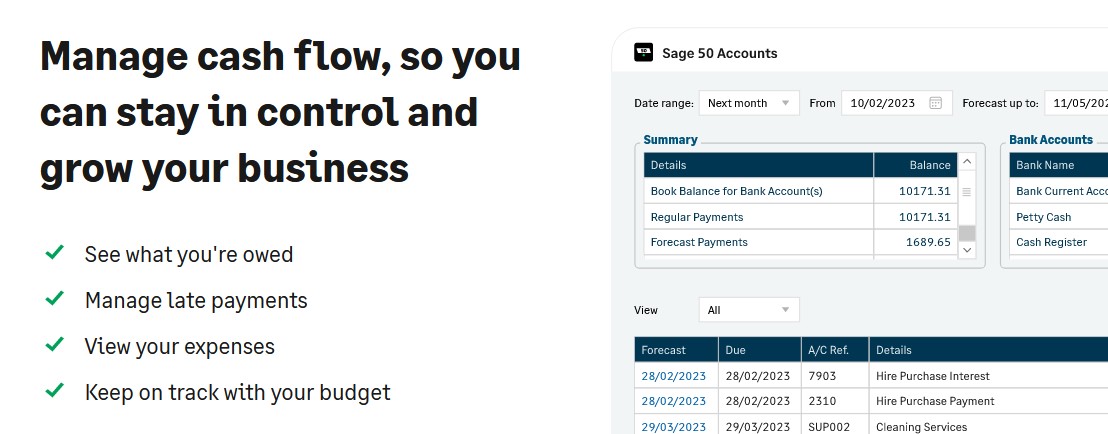

6. Sage 50cloud

What it offers:

Sage 50cloud is a comprehensive accounting solution that combines traditional desktop software with cloud access. It’s well-suited for businesses with more complex accounting needs.

In addition, Sage offers comprehensive reports on your accounts receivable. Having accurate knowledge of the amounts owed by your customers or suppliers is crucial for small businesses. Sage assists in effectively managing invoices and tracking payment deadlines.

Sage excels in tracking your accounts payable too, ensuring your business maintains good relationships with suppliers. It provides timely reports and payment notifications, keeping you informed about your outstanding balances and payment due dates for each supplier.

How it can help your business:

Home service businesses appreciate its robust features, including inventory management and advanced financial reporting. Sage 50cloud provides a scalable solution as businesses grow.

7. Kashoo

What it offers:

Kashoo is a user-friendly accounting software that offers features such as invoicing, expense tracking, and bank reconciliation. It’s designed for small businesses and freelancers.

Kashoo excels in providing real-time financial reports and an array of attractive invoice templates that you can customise to your brand. The software simplifies the process of capturing and categorising expenses by allowing you to take pictures of receipts and upload them directly into the system. Moreover, Kashoo’s bank reconciliation feature ensures that all your financial records are in sync, reducing the risk of errors and discrepancies.

How it can help your business:

With its straightforward setup and navigation, Kashoo is perfect for home service professionals who need a hassle-free accounting solution. It also integrates seamlessly with payment processors for easy transaction management.

8. OneUp

What it offers:

OneUp is an all-in-one accounting software with modules for invoicing, inventory, and banking. It’s designed for small businesses looking for comprehensive financial management.

OneUp not only provides the necessary tools for accounting, but it also offers features for CRM and inventory management, making it a comprehensive business solution. It’s impressive in terms of automation, as it can synchronise with your bank account and categorise banking entries by itself, significantly reducing manual data entry and the potential for human error.

In terms of inventory management, the platform provides real-time inventory tracking and alerts, ensuring that you’re always informed about the status of your stock levels. This feature is particularly useful for businesses with physical products.

How it can help your business:

OneUp’s automation features, such as bank reconciliation and invoice reminders, make it a time-saving choice for home service businesses. Its scalability ensures it can grow with your business.

9. AccountEdge Pro

What it offers:

AccountEdge Pro is a desktop-based accounting software with features like inventory management, payroll software processing, and time billing. It’s suitable for service businesses that need robust functionality and it caters to small businesses with more complex accounting needs.

AccountEdge Pro offers a wide range of features designed to streamline your financial management process. An outstanding feature is its payroll processing capability, which allows you to run multiple payrolls, track wages, and manage deductions effectively. With the time billing feature, businesses can easily track and bill for their time, making it an ideal choice for service-based businesses.

The robust inventory management feature of AccountEdge Pro aids in tracking sales and purchases, managing backorders, and even creating build assemblies for manufactured goods.

How it can help your business:

Home service professionals appreciate the desktop functionality and robust feature set of AccountEdge Pro. It’s a reliable choice for businesses that prefer a traditional software approach.

Aside from the aforementioned features, AccountEdge Pro’s comprehensive business management capabilities significantly enhance business efficiency. The software’s job tracking feature allows you to monitor the progress of jobs and projects closely, providing a clear picture of productivity and profitability. Furthermore, AccountEdge Pro’s detailed financial reports provide valuable insights into your business’s financial health, assisting in informed decision-making processes.

By centralising financial management tasks, AccountEdge Pro not only saves time but also provides a holistic view of your business operations, making it an indispensable tool for home service businesses.

10. ZipBooks

What it offers:

ZipBooks is another solid choice in cloud-based accounting software that offers invoicing, expense tracking, and financial reporting. It’s designed for small businesses and freelancers.

Moreover, ZipBooks provides comprehensive financial reports that give insights into the business’s revenue, expenses, and overall financial health. This feature aids in informed decision-making, helping businesses strategize and plan for growth.

How it can help your business:

ZipBooks provides a user-friendly experience with essential accounting features. Home service businesses benefit from its affordability and straightforward interface, making financial management a breeze.

Revolutionise home service finances with suitable accounting software

Investing in the suitable accounting software for your home service business can revolutionise the way you manage your finances. By fostering automation, efficiency, and providing valuable insights into your business’ financial performance, you’ll be well on your way to growth and success.

Take control of your home service business’ finances today and explore the top 10 accounting software options listed above. With each solution tailored to meet the unique needs of businesses like yours, there’s no better time to get started on revolutionising your financial management process.

So, choose the one that best suits your business needs and start reaping the benefits of efficient and streamlined accounting. Happy bookkeeping!